Meeting Topic

On Mindset – by Kathryn Scordino

Growing up in the 80’s my Dad would often say that the key to success came in two parts. First was talent or skill. In order to do well at something you had to tune in to what you were good at. The second part was what he called drive. The motivation to keep going in the face of adversity, push through when something was hard and motivate yourself to do the very best that you could. I’m sure this wisdom enabled me to keep going and eventually pass my driving test third time around!

In today’s world, the two things that Dad described would be the very definition of mindset. The beliefs, attitudes and perspectives that we have…..our lens on the world and how we view our place in it. Much has been written about mindset in the past couple of decades, popularised by Carol Dweck’s research which describes mindset as falling into two categories, growth and fixed.

Growth mindset is a person’s belief that their skills, knowledge and intelligence can be expanded and developed. In contrast, the fixed mindset is the opposite, that these things are pre-determined, set and cannot be shifted. Dweck believes that changing our beliefs can have a big impact. That growth mindset creates a powerful passion for learning and brain expansion. In her book ‘Mindset: The new psychology of success’ she writes ‘why waste time proving over and over how great (or not great) you are when you could be getting better’. In other words, why hide from our worst characteristics, habits or failing when we could overcome them.

Dweck importantly says that no one is wholly a ‘growth mindset’ or fixed mindset’ person. We all will be in both places at various times and places in our lives. But how much time we spend in one place over another is a choice. Something we have control over and an ability to decide how we look at life or work circumstances.

As women business owners, confidence, or our belief in ourselves is often a mindset that keeps us from backing ourselves and our true potential. Our businesses might be doing ok, but is our mindset stopping us from thinking big, growing our capability or expanding beyond the current reality.

A resource I’ve found useful to shift my own mindset is the ‘Confidence Code’ by Katty Kay and Claire Shipman. In it they share some brilliant lessons:

- Stop overthinking – instead trust your gut instinct. If you wait for perfect, it will never happen. Instead give your idea a try. It could be the best thing you ever did!

- Take more risks – confidence builds when you step outside your comfort zone. Taking a risk is backing yourself to learn and grow. If it doesn’t go right first time, it will be better the next. Ask yourself ‘What did I learn here’

- Action breeds confidence – the practice of consistent small actions is far more likely to create success in the long term than a single, life-changing moment. Like saying yes to that client that scares you because the work is out of your comfort zone, or adding to your business with a product that you haven’t yet mastered the details of. The small wins add up.

- Celebrate effort, not just results – focus on celebrating yourself for what you did or tried, not being the harsh judge of the small things that didn’t work.

Kathryn is a Leadership Coach and facilitator with a specialism of working with women business owners and leaders. You can find out more via her website [1]

Next Meeting Topic

Strategy by Shona Mookerjee

The Vero Centre in Auckland CBD has this quote on the wall – `we haven’t the money, so we’ve got to think’. Most of us have a plan; but do we have a strategy? And is there a difference?

I’m a self-employed, insurance adviser of nine years and these three fundamental principles work! I’ll explain them and leave you to make the application to your business.

- Interrogate the Numbers – I’m amazed at how many businesswomen don’t know their numbers. Numbers tell us about financial performance, the cost of overheads, and the amount of tax to pay; but what do they mean? Digging behind the numbers helps set strategy. E.g. where does my business really come from, what’s changing, and what isn’t working? In 2023, my business revenue fell 19%, thanks to a sharp drop in new client referrals. Hence, I grew my KiwiSaver business to compensate for lost revenue and targeted my customer base for new business. As a result, 37% of my 2024 revenue came from non-traditional channels and current customers. Interrogating the numbers can reveal new markets and future trends. My numbers are telling me, more people in their 60s need insurance because they’ll have mortgages to pay well after they retire. What are YOUR numbers telling you?

- Consider Your Positioning – Unique Selling Proposition and Competitive Advantage, are great buzzwords but the reality can be VERY hard to accomplish. Search Insurance Advisers and see – everyone has a website that extols their amazing customer service. Everyone can’t be # 1. How do you differentiate yourself? Answer – Positioning – occupying a UNIQUE position in your client’s mind. Mine is, Sh*t Happens Shona – it always gets a laugh, but it sticks! It’s smart. Where does rubber meet the road for an insurance client? During a claim! Once you know what your Position is, shout it from the treetops. Positioning helps you turn a disadvantage into a strength. Wrap your strategy around it. Remember, you can’t be everything to everyone. Pick one spot and occupy it.

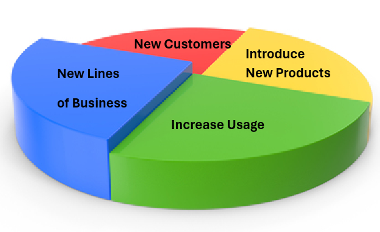

- Establish Value – we know the price of something but not always it’s value. Price is a number, but VALUE – like beauty – is Perception. Giving your client information that is news to you but not to them, is spam. Generic emails are low value, and your client doesn’t care about the industry conference you attended. Information that your CLIENT values is currency. I use my networks to connect my clients with real estate agents, mortgage brokers, lawyers, accountants, photographers and travel agents. I help them reduce their ACC levies, sort out their vehicle insurance and get their wills done – and though none of these relate to my business, this creates opportunity. If, over time, you establish a clear value proposition for yourself with your client, you establish trust and become a source of value. It pays rich dividends in the long run.

Your plan for your business is your HOW; the strategy behind that is your WHY. Translating these three lessons into your business will go a long way towards sharpening your axe and bringing you success.