The Vero Centre in Auckland CBD has this quote on the wall – `we haven’t the money, so we’ve got to think’. Most of us have a plan; but do we have a strategy? And is there a difference?

I’m a self-employed, insurance adviser of nine years and these three fundamental principles work! I’ll explain them and leave you to make the application to your business.

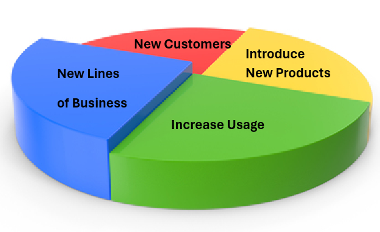

- Interrogate the Numbers – I’m amazed at how many businesswomen don’t know their numbers. Numbers tell us about financial performance, the cost of overheads, and the amount of tax to pay; but what do they mean? Digging behind the numbers helps set strategy. E.g. where does my business really come from, what’s changing, and what isn’t working? In 2023, my business revenue fell 19%, thanks to a sharp drop in new client referrals. Hence, I grew my KiwiSaver business to compensate for lost revenue and targeted my customer base for new business. As a result, 37% of my 2024 revenue came from non-traditional channels and current customers. Interrogating the numbers can reveal new markets and future trends. My numbers are telling me, more people in their 60s need insurance because they’ll have mortgages to pay well after they retire. What are YOUR numbers telling you?

- Consider Your Positioning – Unique Selling Proposition and Competitive Advantage, are great buzzwords but the reality can be VERY hard to accomplish. Search Insurance Advisers and see – everyone has a website that extols their amazing customer service. Everyone can’t be # 1. How do you differentiate yourself? Answer – Positioning – occupying a UNIQUE position in your client’s mind. Mine is, Sh*t Happens Shona – it always gets a laugh, but it sticks! It’s smart. Where does rubber meet the road for an insurance client? During a claim! Once you know what your Position is, shout it from the treetops. Positioning helps you turn a disadvantage into a strength. Wrap your strategy around it. Remember, you can’t be everything to everyone. Pick one spot and occupy it.

- Establish Value – we know the price of something but not always it’s value. Price is a number, but VALUE – like beauty – is Perception. Giving your client information that is news to you but not to them, is spam. Generic emails are low value, and your client doesn’t care about the industry conference you attended. Information that your CLIENT values is currency. I use my networks to connect my clients with real estate agents, mortgage brokers, lawyers, accountants, photographers and travel agents. I help them reduce their ACC levies, sort out their vehicle insurance and get their wills done – and though none of these relate to my business, this creates opportunity. If, over time, you establish a clear value proposition for yourself with your client, you establish trust and become a source of value. It pays rich dividends in the long run.

Your plan for your business is your HOW; the strategy behind that is your WHY. Translating these three lessons into your business will go a long way towards sharpening your axe and bringing you success.